This is an abridged version of a longer essay, intended for sharing publicly! May it inspire and benefit U ❤️

Last year, my friend Maeby asked some friends about their money stories. I saw them share their histories with money, their problems and challenges, the ways that they have changed their views on money over the years. People felt safe to share honestly and vulnerably, because it was in a cozy semi-private space of friends online. The stories produced a really vibrant and generative discussion, and I think everyone learned something.

At the time, I didn’t jump in. I wanted to write up my money story, but felt intimidated. I knew I would have a lot to say and that it would take a long time to write mine. I had other writing projects at the time that I was busy with, and frankly, I probably had some resistance to thinking about money and looking at this area of my life clearly. But I set the intention to do so when I felt ready. Working on my financial situation has been an ongoing effort for some months, and in early January 2026, it has finally felt like time to write my money story1If U’d like to make a money story of your own, here are some questions U might ask yourself, many of which I answered as part of the process of writing a first draft of this piece..

Early Money Memories, Family Values, and Broader Culture

My mom really valued frugality. She was always using coupons and refunds and other tactics for minimizing how much she spent. She and my father made enough money, but she did it because it brought her joy. She especially loved to get things for free or cheap that she could give to someone she loved, or to someone in need, like the local soup kitchen.

My mom tried to teach me this virtue. She would take me to the grocery store and tell me about her coupons and have me help her shop.

My parents were very diligent about money, from what I could see. We always had money to buy food at the grocery store, or whatever else we needed. They balanced their checkbooks regularly. They paid their mortgage. They saved money for my education and their retirement. My mom had spreadsheets for managing her money and my Dad had these big ledgers with god knows what in them.

I never felt like we didn’t have enough. There was always food on the table. I never heard anything about paying the rent or the mortgage. Our house was just: our house.

I do think my parents also were anxious and stressed about money. They did their best to keep me from their discussions and arguments about money, but I think it was one of the main things they argued about or at least frequently discussed tensely.

Looking at pictures of my Dad, when I was young, he looks free and happy and innocent in a certain way.

Later, he began to look far more stressed and tense in pictures. My sense is that the realities of having a wife and a kid and a house set in—that he would have to, for example, work a job he really didn’t like or want to be at, in order to maintain his way of life and a set of obligations he had opened himself up to.

My hometown was very wealthy, and I noticed a discrepancy between the amount of money we had and the other families had. Our house was more modest, functional than a lot of the other houses. In a more humble neighborhood, near a poorer neighborhood, on the edge of town.

Our house wasn’t a multistory mansion on the water. We didn’t have a riding mower. My dad would mow the lawn with a push mower once a week—not even an electric push mower. We were comfortable, and had what we needed—but nothing excessive or luxurious.

Starting to Make Money

My mom gave me an allowance as a kid. I don’t remember what it was, maybe three or five or ten dollars a week. I was always excited to get my allowance, and would try to negotiate for more money. A raise in my allowance made me very happy.

I wanted to buy toys and games and Legos and Pokemon cards at the local toy shop, Over the Moon. My allowance wasn’t enough to buy all the toys I desired. I sometimes had a lemonade stand, which was a way that I could make some extra money.

My first job was actually working at Over the Moon. They hired me during the Christmas season to tidy the store and wrap presents and that kind of thing. I loved working for them and they gave me a deal on toys, I think. I’m not sure how much I actually helped them but it made me happy.

At this point my parents helped me open a savings account at the local bank. I enjoyed putting money away, although I didn’t really have any particular sense of what I was saving for.

My second job was working at the summer camp I went to for many years, Derby Summer Arts. The camp had “classes” that the campers signed up for and went to every day—but instead of being things like Math or Language, they were on arts-related classes. I taught chess, tech theater, and newspaper class. I was happy there, too.

My college work study job was working in the IT office. I would help debug problems for the students and the tutors (what St. John’s calls professors) and the staff. I would also have sessions in the computer lab, keeping an eye on the computers, watching the printers, that sort of thing. Mostly I could do homework there in that basement during those hours.

I remember when I got a checking account, they taught me to manage my checkbook, and I did for a while, but at some point I realized I didn’t really need to. And I lost a bit of trust in my parents’ sense of money, that they were so devoted to doing something that seemed kind of pointless as best I could tell.

I was suspicious of credit cards. It seemed like a way for companies to prey on people, to make money off them. I didn’t sign up for one.

Frugality and Simplicity

I remember in college, talking to my Dad about something about money. I don’t remember what and I wish I did. I do remember where it was—near Francis Scott Key Hall at St. John’s, near the dorm that’s right near there—Campbell Hall, I think.

I think I was worried about spending money on something. He said in passing: “That’s what money is for, right?” Then he kind of energetically gave me permission to spend money on something I needed. That was the beginning of my simplicity arc, I think.

To me, frugality is about spending as little as possible. Trimming the fat, cutting corners, squeezing every last drop out of something. Similarly, minimalism is about having as little as possible.

Both frugality and minimalism have a similar virtue, I think, but it’s also fundamentally a scarcity mindset. I think it’s good not to waste things, food or money or resources. And I think it’s good to be resourceful, to know how to navigate various systems and know how they work.

And I just fundamentally don’t want to come from a place of anxiety or worry with money, or from a scarcity mindset. I don’t want my life to be barren and sparse, just for the sake of some abstract virtue.

Early Career as an Adult, Monastic Training and Financial Situation

In 2014, after I graduated from college, I worked as a contractor for a few months, doing Clojure programming. I was paid something like $100 an hour at the time, which was a lot—and I was working many hours per week for them. That was probably the most income I’ve ever had.

It was good money, but not a great job. I was excited about the technology they were using, and I liked my coworker, but I gradually realized that I thought what they were building was more or less unethical. It was some kind of fancy marketing aggregation database service, using a very cool kind of programming called logic programming. But it wasn’t in accordance with my values, and frankly, I wasn’t very good at it, either. I quit to join the monastery.

The least income I’ve had as an adult was probably either when I was doing work-study in college and actually going into debt, or when I was at the monastery—I received a small stipend each month the whole time I was there. I made that money go as far as I could. It helped that I had some savings from my contracting job.

In 2017, I received an inheritance from my grandparents—my Dad’s father Jim and his wife Bev, after she passed away. Initially, I was very very happy and thought, “I’m rich! I can spend money on whatever I want!”

My biggest expenses were paying off my partner at the time’s college debt and buying a car.

Through some grace, I decided to look into budgeting software. I learned about You Need a Budget (YNAB) and started using it. I saved a lot of money because that made me realize if I spent money on one thing, I couldn’t spend it on something else. I couldn’t have my check and spend it, too.

I budgeted diligently during that time. I still spent money on the things I felt called to, but I was more conservative than my initial period after receiving the inheritance.

At MAPLE, there was this thing called the grant program. Soryu said that if we made a meaningful, significant shift in our meditation practice—as determined by him—we would be eligible to apply for a grant to work on a service project of our choosing. If our application was accepted, and we got the grant, we would receive some funds (up to $1,000) and some time off from the monastery to work on the project. The intention was to create mutually supportive feedback loops between wisdom (as cultivated by meditation practice), love (service), and power (in this case, money and time).

I got the grant twice. The process of deepening my meditation practice, becoming eligible to apply for a grant, learning how to make a grant application, and then executing on my project was very valuable to me. It helped me to learn to do fun service projects. I made a book, Maple Seeds, that I co-authored with Soryu, to present his teachings in an accessible way. And I hand wrote a book, Here to Serve, using digital art on an iPad2I was using a program called Zoom Notes at the time, rather than Procreate, which I’ve used in this present era of my life as a digital artist—2021-2026..

The grant application process taught me a lot about fundraising. Soryu used the whole thing as a teaching program to help us to learn to apply to grants, to think like funders. There was an application form we were supposed to fill out, that had all kinds of helpful questions to consider as we crafted our proposal. We were also supposed to time box how much time we had to fill out the application.

Later, we began receiving formal training in fundraising, from Soryu as well as his father, Scotty, who had done fundraising professionally for his whole career for a major environmental nonprofit. The education we received was excellent. I later shared what I learned during this time in my blog post, Learn You a Fundraising For Great Good!.

Learning fundraising brought about a major change in how I related to money. I’d implicitly taken having the opportunity to be at a monastery for granted. I saw how lay people could cultivate the spiritual virtue of generosity by making financial gifts that made contemplative practice possible. I had to face layers of ingrained shame and resistance to power in actually doing fundraising—making asks, writing letters, applying to grants, etc.

I came away with an instilled confidence that if there was a project I wanted to do that was good for the world, then it was worth raising money for—and I had the confidence and lived experience that I could raise that money.

The most money I raised in one go was probably $60 or $70k for MAPLE. I was the Assistant Executive Director in Vermont and the Fundraising Director. They were trying to build a new building, a Zendo for meditation. When my mom saw that I could raise that much money, something in her relaxed. Even though I’d made seemingly strange life choices, she saw that I could take care of myself, that I wasn’t completely foreign to systems of money.

Reading Lynne Twist’s book, The Soul of Money, was a turning point for me. I believe I read it in 2020. Twist talked about money as energy, life force. She had a clear service orientation in relation to money and it gave me glimpses of what a healthy, values-aligned approach to money could look like. I think it took me years—is taking me years—to really implement and live up to what I learned from that book, but she really crystallized a vision.

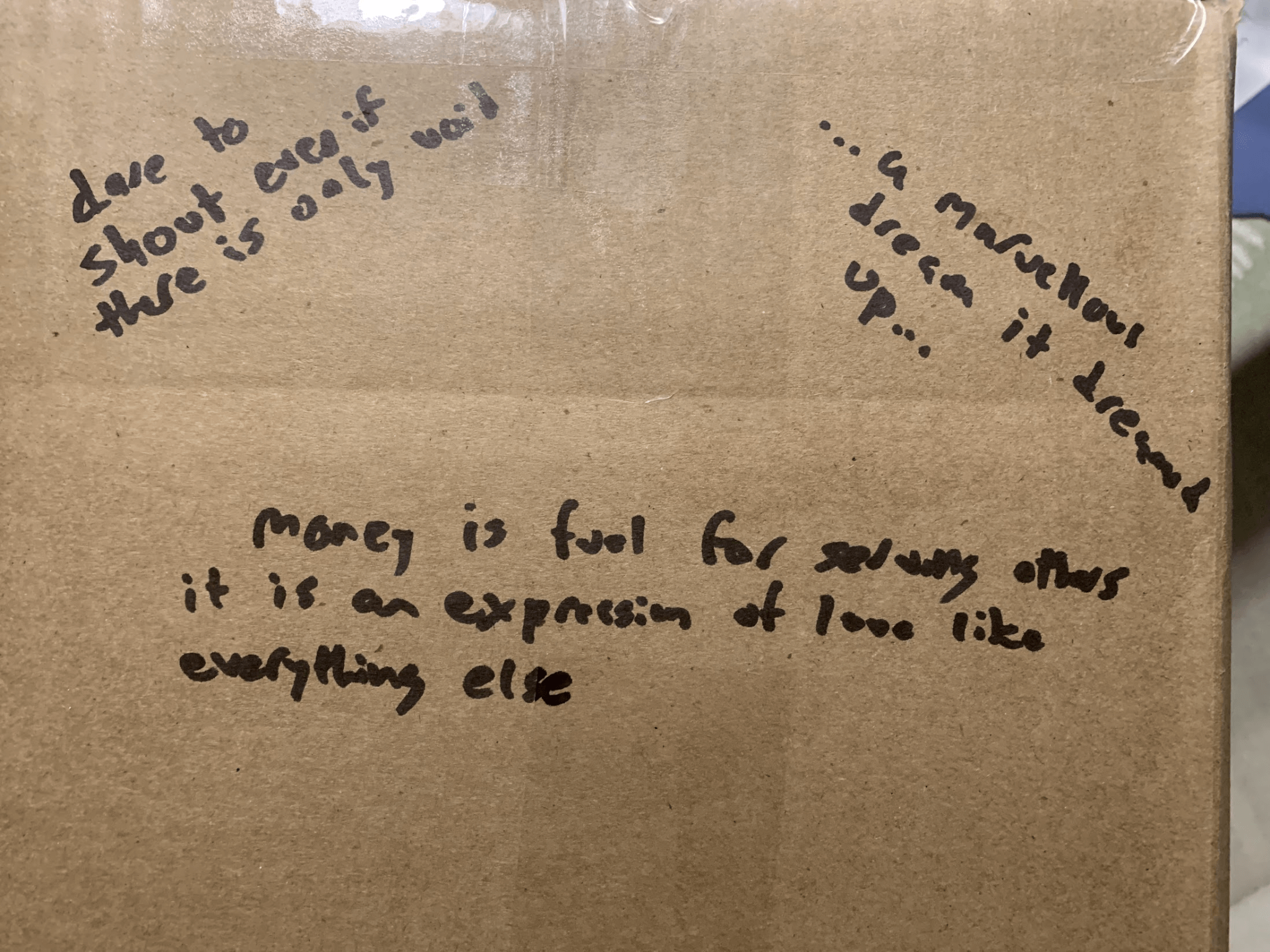

My MDMA journey in 2021— “The Day I Was Born”—created a fundamental, before and after shift in my consciousness. That shift extended to how I viewed money, too:

- money is fuel for serving others. it is an expression of love like everything else

- fundraising is critical finish that article so others can help

- abundance and scarcity are key themes. see and act from abundance. scarcity is a block to deeper service and joy

- live from abundance

- be a wandering monk, an itinerant, owning little and playing much sharing everything you have

- you don’t need to store or keep money

- use it and give it away as you feel called and more will come, it is just fuel for the journey

- poverty is abundance

- receive every gift, give every gift, let generosity flow through you

- mentors and coaches and courses and books are all fuel for deeper service

I tried to embody that lesson on my pilgrimage. I tried to practice trusting that my needs would be met. That I could spend money on whatever I felt called to, or needed to. Sometimes I wanted to spend money on things that I couldn’t justify logically or explain rationally. But my heart called me to them, and I trusted that, and more abundance and joy came into my life, more benefit into the world.

I’ve valued autonomy and freedom to follow my own sense of fun, aliveness, eros & resonance over stability, comfort, legibility, or living a “normal life” in the “real world.” That has exposed me to much more volatility than most people. I’ve had to live a simple life in order to make it work—not paying rent or owning a car or taking on debt or buying a TV or…

Fundraising for Projects

The thing I’ve most wanted to spend money on is service projects. I love service projects—they are genuinely fun for me, and I truly believe they benefit the world.

In June 2021, I tweeted:

some day I want to get a GoPro and work with an incredible animator to make a rotoscoped version of what it looks like in my mind’s eye when I do metta while out and about, walking or running or dancing or doing Tai Chi

When I tweeted that, I thought it might be a decade before I could manage to do that—to find an animator, to find funds, to make it happen. Turns out, it took eight months! I raised funds and we filmed the video that month. I hired my friend Danny J to make the song for a music video. Zachary Hundley came forward with the animation skills. The animation took the longest portion of that time.

I raised ~$7,500 total for that project, which is to this day the biggest budget project that I personally have initiated working on, not for someone’s nonprofit or company. The Service Guild technically didn’t exist yet but this would have been a Love Department project.

Most of the service projects I’ve done since then have had smaller budgets. I’ve done some $1,000 or $4,000 dollar projects. But nothing as big as that animated music video—yet!

I’ve really learned how to work with what I call “duct tape”—not literal duct tape, but metaphorically sticking projects together and making them possible through creativity and effort and spare time cobbled together from a number of talented, skilled, dedicated collaborators.

U can do cool, fun, impactful projects for free or dirt-cheap, especially in the internet age. i’ve built my skills and made my bones doing things cheaply, with duct tape, before advancing to more expensive, complicated, ambitious projects.

In the beginning, I would do projects with zero budget, that didn’t make any money. If projects made money, I would split them 50/50, or evenly with all my collaborators. That’s a perfectly good way of doing it, but I have since explored other ways of dividing income between groups.

In 2025, Mary and Anansi and I—the Empowerment Department—led a new cohort of our Give Your Gift program. As an experiment, at the end, we did a “Happy Money Story.” Mary led us through this exercise, which comes from Greater Than.

It was my first time doing this, and I wasn’t sure what to expect. We each shared our current financial situation, what we had contributed to the project, what we saw and appreciated the others doing. And then we each made proposals for how to distribute the money that came in from the project.

The crazy thing is that each of us earned more than we initially proposed to receive ourselves. Say I wanted to pay myself $100—everyone else wanted to give me $125. And the numbers worked out! So we all got more than we expected or thought we deserved or would have allocated for ourselves. That really made an impression on me.

All of us were indeed happy with the final distribution and felt it was fair and reasonable considering our respective situations as well as the work we’d done on the project.

Being A Feral Free Agent

I’ve had this sense for a while that when U are an independent, a “feral free agent”—it’s hard for a few years. U aren’t necessarily even “ramen profitable” in startup language. Things are slow. U have to put in the work to show the world who U are, to become legible to them in a way that they can understand and receive. It takes years of effort of showing up consistently, being yourself loudly and clearly in public, for anyone to really hear and take notice.

But eventually, momentum starts to grow. Things start to go your way. It’s like a hockey graph that’s really slow to start and then suddenly explodes. I think it might take someone three, five, seven or eight or even twelve years to hit that point. It varies, of course, based on who U are, what your skills and experiences are, who U are connected to. But if U put in the effort, if U are consistent in showing up, I have confidence U can hit that point—that I will hit that point, that U could too. “Show up, don’t die, don’t quit”, as Visa says.

i guess i am betting, believing as an act of faith, that money, sustainable income and flow of resources, is a second-order consequence of Right Livelihood, of a life well lived, of living one’s vow, of acting to maximize fun and aliveness, benefit and impact

Gratitudes, Fears, and Shadows

For the last few years, I’ve been supported largely by generosity—my Patreon, and one-time donations, including several large gifts that came at just the right moment. My Patreon has made my way of life possible for the last few years, and I am so grateful for the generosity of so many people and the grace of God.

I feel grateful to everyone who’s supported me. I am interested in learning about them, being connected to them, supporting them in their lives. I feel blessed that I get to work on projects of my own choosing, that are fun for me and beneficial to the world. I feel a sense of freedom that I get to choose what I work on, that I have autonomy, that I am not obligated to anything or anyone in particular. That I can trust my own intuition, even when it’s illegible or weird or uncomfortable for others. That I can’t get fired, or told what to do, or what not to. I feel deeply connected to other people. I experience myself as a gift, my work and time and energy and presence as a gift. I give the world a gift through my being, and if they so choose, they can give a gift back. No one is obligated to give me money, and I am not obligated to give anything in particular. I feel free, deeply connected, at ease.

And—my Patreon is currently covering something like 40% of my and The Guild’s expenses. That’s not sustainable! At least not right now.

Sometimes I’ve been afraid of having no money and being homeless and not being able to eat food but honestly that doesn’t feel very likely and I don’t think my emotional body is scared of that these days.

I remember in late 2021, early 2022, a few months into my pilgrimage, I realized I was worrying about money a lot. I realized that, from a phenomenological perspective, that was the hindrance of worry and anxiety. As soon as I saw that these thoughts were that type of phenomena, they diminished in strength significantly.

At that moment, I set the intention, to never worry about money again. I promised myself I wouldn’t. It’s not that those worries never come up—they do, from time to time. Instead, my intention is to notice it, to recognize it as worry, and to let go of it each time it arises. To surrender my worries to the universe.

This intention has largely worked since then. It seems like the worries recur when I’m in a new chapter of my life, or feel a new sense of responsibility for others, beyond just myself. But largely, I try not to worry about money, but instead to make good choices about it that I’m proud of.

worry is not a trustworthy compass

I’ve been supported by generosity for four years. The first month I got $100. I felt good about that, because I didn’t expect anything. But these days, nearly five years into having a Patreon, I get… $1800 a month. It’s also given out in chunks because like, one person gives me $10k in September so I get that in October. It’s more like $900 a month, give or take.

I’m incredibly grateful to everyone who’s ever supported me. And I will admit that some part of me… disprefers, resents, begrudges that I’m not making $3 or $5k/month. I do the work for it. I benefit the world to that degree. I work hard literally every day doing my projects.

Some part of me wishes I didn’t have to do commercial work, that I could only work on my own projects. I trust my intuition, I trust my discernment about how to spend time. So that part of me resents having to launch commercial offerings or work with clients or run programs.

I often have a lot of fear, confusion, shame, anger, and resistance when filing my taxes. I’m afraid of unintentionally doing it wrong, and being fined years later for it in amounts I don’t have or consider fair—or I’m afraid of being jailed for filing my taxes wrong, or doing some bureaucratic need around money incorrectly. I don’t think I’ve sat with this fully.

I’m afraid and resistant to having to explain my financial choices to someone. I’m afraid that a partner, my future wife, or my team might second guess my own intuition, which I trust very deeply. I want to be able to spend money that I earned or am in charge of in ways that I see fit without having to justify or explain them to someone else.

I don’t think I’m very ashamed in relationship to money. Maybe I’m ashamed sometimes that I can’t buy things that my friends buy or make use of.

Relating to Larger Financial Institutions and Infrastructure

In 2024, I started using a credit card. While I’d previously thought of them as manipulative scams, a couple of friends helped me to understand that they are actually quite useful for people who use them responsibly. Credit cards can save U a little money, get some rewards, and also establish a history of credit.

I’ve paid off my credit card every month that I’ve had one. I didn’t think about it at the time, because I was still on my pilgrimage, but I see that having a credit history will be useful for getting an apartment, and I suspect for other projects and endeavors in the future.

Investing History and Philosophy

My first foray into investing was with crypto, in the crypto boom of 2017/2018. I decided to buy amounts that I could stand to lose, and “HODL.” I haven’t sold anything that I’ve bought. The values have fluctuated, but I barely look at them, and I still own what I’ve bought. Haven’t really used it for any purchases. I foresee the prices going up over time.

Later, I bought some index funds, and did well for myself. Then I started buying a few individual stocks that I thought would do well. Those did in fact do well.

I realized that I was developing an investing philosophy of my own—one that I hadn’t heard anyone talk about, exactly. I wouldn’t guess that this philosophy is entirely novel, but no one taught it to me.

Here’s how I see it. When I buy stock, I own the stock itself, not a fluid amount of money. I focus on owning specific shares (like “44 shares”) rather than thinking in dollar amounts. This perspective helps me to stay grounded in actual ownership rather than reacting to price fluctuations.

The stock represents an option to sell for a fixed amount of money at a given point in time, but what I actually possess are the shares themselves—actual pieces of the company (albeit fractional ones).

I imagine that, if we fast forward 5, 10, 20 years, I will have bought shares at a relative local maximum / bull market (and perhaps before bearish periods) but still at a lower point in the history of the stock overall.

I’m hoping that even if I take hits on owning stock in any given year, in say three or five years my shares will be very valuable, and more so than if I had just invested in a total stock market index fund.

So I’m not trying to find the perfect timing to buy a stock. I don’t need to worry if I’m buying at a suboptimal price, or losing fractional amounts if I’d bought a week or a month or a year sooner or later. Instead, I am purchasing a stock that I anticipate will do well on five, ten, twenty year time spans—for a company whose value will go up over time.

When I’m ready to sell, I plan to sell portions (e.g. 25% or 50%) at certain value levels. This will allow me to maintain exposure to future growth.

This philosophy has seemed to work so far, for the limited time that I’ve been investing. I’ve made significant returns on the modest amounts that I’ve invested already. That said, the markets have largely been doing well during this time, so I can’t credit my nascent investing philosophy too much.

At some point I realized that buying an individual corporation’s stock is like casting the “I believe in U” spell on an individual, but towards a company.

This is the spell that I cast through my Empowerment work, symbolized by the wand on my right arm.

When I say it to an individual, I am saying “hey, I see U, believe U have a vow. I see what U are trying to do, I think it’s good. I want to be connected and help in any way I reasonably can.” 🪄

I can do this same move at a higher scale, in a larger context, by investing in a company.

If I have invested in an individual stock, I’m primed to look for information about that company, to see if I can help it. And that is the basis of mutually supportive feedback loops—the conditions for good consequences.

I’ve purchased a handful of stocks since this realization. I’d like to do more of this kind of investing in the future.

Beginning the Abundance Era

I would summarize my money journey so far as follows. It seems to me that I trained in a successive series of virtues: frugality as a kid (taught by my mom), simplicity in my twenties / early thirties (starting in the context of the monastery, then as a pilgrim). Now it’s time for a third stage, Abundance and Wealth, which builds on those virtues. Abundance is not in conflict with simplicity or frugality, but is the natural evolution of them.

Frog of Abundance by Sílvia

Reading Zencephalon’s Wealth Affirmations initiated was perhaps the beginning of this new era. Zencephalon embodies a lot of virtues I admire, and is also a strong advocate for having a healthy relationship with money, wealth, business, and the economy. He inspired me to start cultivating those skills and attitudes, too. I can’t recommend these affirmations highly enough to my friends!

Another instrumental influence was a very weird, very woo, eclectic book that I heard about from Zencephalon, who in turn heard about it from Tom Morgan: Busting Loose From the Money Game by Robert Scheinfeld. This book—with its very quirky, derpy 90’s consultant-style Windows XP-desktop-lookalike green-grass cover—has views that are in accordance with my more woo views about reality. Heck, this book is off the woo deep end, past some things I really clearly and firmly believe.

The main idea is that the universe is a hologram, that we are actually infinite consciousness, playing a “Human Game” where we pretend that we are finite humans for a while as a form of entertainment / learning / growth / experimentation.

The game has two phases: Phase 1, where U do your absolute best to convince yourself U are a limited human with a particular personality and character. Phase 2 is about removing those illusions, reconnecting to your infinite creativity and power, and using that connection to source to bring about miracles—unbound from finite limitations and beliefs about money.

The book suggests some practices that remind me of what I understand Existential Kink to be on about, for dissolving illusions about money and instead welcoming in a sense of abundance and potency.

Someone else who inspired me was Andrew Rose. I’ve known Andrew peripherally for many years, and we’ve been mutuals for some time, but I would say we really became proper friends and allies in Spring of 2025. I look up to Andrew in many ways. He is just as ambitious as I am, if not far more—but has specific skills that I can see are helping him to realize those ambitions at a bigger scale or faster speed or larger impact than I am presently able to. A lot of those skills have to do with what I would describe as a fluency with commerce and business and entrepreneurship. Seeing his example inspired me to go deeper into learning these skills too, after many years of flirting with but not mastering them.

I made a friend in 2025 that is independently wealthy. They had worked hard in their twenties with a FIRE philosophy—worked hard, saved a lot, spent little. At first, they worked as an employee, and later set up their own freelancing businesses. When we met, they were also exploring making merchandise.

They did very well for themselves. I saw them as resourceful, entrepreneurial, hard-working, clever. I really looked up to them. Talking to them inspired me to get more interested in business and make more commercial offerings.

This friend sent me an article, What they don’t teach you in Freelancing School, by Sammy Cottrell. It was making the rounds elsewhere, also, and I devoured the article. The article included a call to action to schedule a call with Sammy. I booked a call and was astonished to find out that even though the article had been on the front page of Hacker News, I was the very first person to actually book a free intro meet-and-greet chat with him.

I was very grateful to be able to spend time with him, get to know him. We felt like fast friends and collaborators, allies. I even got to meet him when we were in NYC at the same time.

And implementing the ideas he put in that article has already been very helpful to me.

In 2025, I found myself doing what I would now call “Livelihood Spells.” It started with a very honest conversation with a friend: discussing their life, goals, obstacles. We agreed to work together on making more money and finding them a job in the coming months.

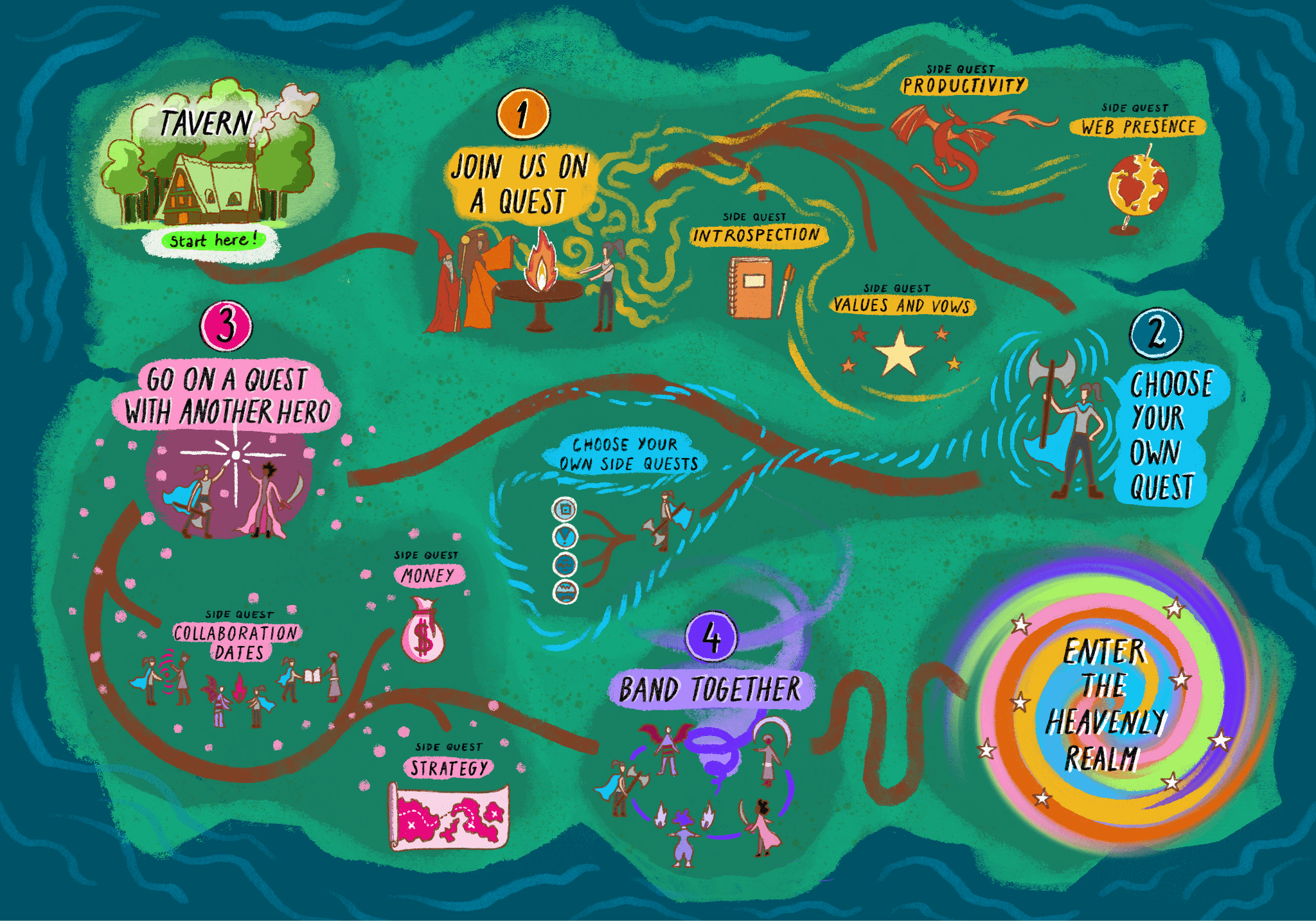

I later made my own spell, and started some with two other friends, also. I would say that all four of us are working on the “Money Side Quest” that’s in the Quest Map I made for the Empowerment Department (which Sílvia illustrated)—one that I have not yet solved.

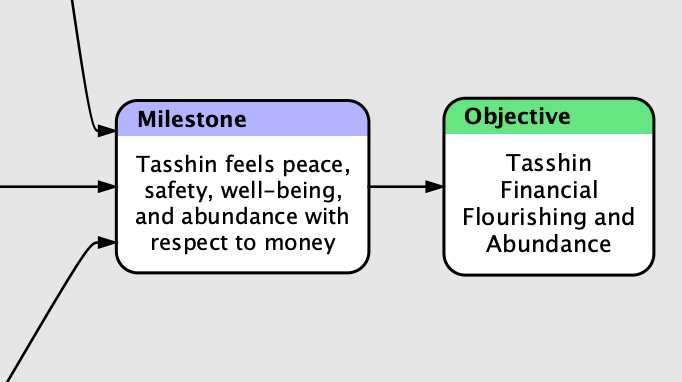

The Livelihood Spell is a way of setting a clear intention or direction, for describing the success condition for someone’s Money Side Quest. Here’s mine:

By June 1st, 2026, I will be earning $3,000 a month or more (or much, much more) through a healthy combination of employment, contracting, generosity, a variety of programs, services, and offerings to be able to support my livelihood and work.

I have the infrastructure to be able to send and receive money legally, ethically, in accordance with current federal and state tax codes: an LLC, a fiscal sponsorship, bookkeeping, accounting, taxpaying, etc.

I am easily able to pay rent and utilities for my apartment (~$1,500-$2,000), and am able to live functionally and comfortably in Brooklyn. It is easy for me to set aside enough money to pay for my taxes.

I feel peace, safety, and well-being with respect to money. My present financial situation and the possibilities in front of me give me a palpable sense of excitement, abundance, and flourishing.

I am well-positioned to create the foundation for a healthy and thriving future for myself, my friends and family, The Service Guild, the world and all beings.

I will do what it takes to bring this about. I will marshal all my inner and outer resources towards this. I will ask for help. May it be so.

Tasshin Fogleman 08/31/25

This livelihood spell has had me focus my efforts on my financial situation. I’ve been looking closely at my financial situation, and making efforts to make my financial situation more sustainable—not only for myself, but also for The Service Guild.

Making a Capital List

When I did fundraising, one of the unintuitive lessons I learned was that U should never accept more money than U can responsibly spend. That U should know the highest amount U can responsibly spend at a given point in time, and not accept more than that.

It’s confusing for people when U refuse to accept their money for a good cause, who want to give, are excited to give—but ultimately it builds trust, and is the right thing to do.

I recently made a capital list—a list of what I would do with more resources. At first thought, I thought maybe the most I could responsibly spend would be $1 million. That already felt like a lot to me, especially since in the past my Responsible-Funds-Number was much smaller.

But as I thought about it, and reflected, I realized, actually, I’m pretty confident I could responsibly spend more. Much more. And that capital list, my list of desires for myself and The Service Guild that I would happily accept money for at this time, ballooned. It’s currently at about $33 million, including the creation of several specific endowment funds for present and future Departments of The Service Guild.

The capital list has categories: NYC, Tasshin Personal, Books and Publication, Love, Curiosity, Empowerment, and Guild. I’d set myself up for success personally, help me move to NYC so that can be my homebase personally and the capital of The Service Guild—help me publish my books, create more responsible infrastructure for finances and project management for The Guild, spur specific service projects for each department and also the long-term health and vision of the overall organization.

I want to feel totally comfortable giving and receiving any amount of money, for projects that I feel called to do, that I feel called to execute through the Guild, or that I want to help other people make happen. I wish someone could have written me very large checks to help make The Guild or its projects possible at different junctures—well, some people did, but even larger checks more frequently. I would like to be that person for people I believe in.

I also just want my own needs met. I would like to not have to worry at all about where I’m living or how much to spend. I can sense the possibility of having multiple homes—my earlier self would have judged that so much but I think I would really thrive with a home base in Brooklyn, a rural home (tiny house?) in a place like Vermont. Even having a home in multiple major cities—SFBA, Asheville, Europe.

I hope we get much more accessible supersonic travel and that I can travel between multiple cities and nations with ease, feel and be at home wherever I go.

If I had homes, and a second monitor, and a personal assistant, and a huge bank account for funding Guild projects… if I had hired help for cleaning and managing my life… if I had a wife that had all of her needs cared for—I could and would use all of that abundance for benefit, to be generous, to pass on all the goodness and skills and benefit I possibly could with my days and years.

I know that in my bones because I’m already doing that to the best of my ability with far more modest means—and I’ve been doing so for years. It’s fun for me, and I love seeing the positive, wholesome effects ripple outwards.

i want to have enough money to meet my needs, and then to seed all wholesome intentions and projects i can help bring into the world

Generosity and Commerce

The big insight that I’ve had so far during this chapter of welcoming abundance into my life is that generosity and commerce can co-exist, be mutually supportive—that they are themselves competing and collaborating in an evolutionary feedback loop.

I’ll be more likely to flourish personally, that The Service Guild as a whole will be more likely to flourish, if we can fluently speak the tongues and use the skills of both generosity and commerce.

So in practice, that looks like developing more commercial offerings, for myself and The Guild. I’d like to have a mixture of generosity-based and commercial offerings and programs. To have a healthy portfolio of different kinds of offerings, and to create mutually supportive feedback loops between them.

I recently made a list of my heuristics regarding money, generosity, and commerce.

Here’s how I think about it right now:

- First and foremost, if it’s dharma or a spiritual teaching (e.g. if it’s related to the Love Department), I will offer it freely / by generosity. Peace Pilgrim said that “Spiritual truth should never be sold—those who sell it injure themselves spiritually.” I believe her. I want to live in a world where spiritual teachings are shared freely, widely, for the benefit of all.

- If it doesn’t cost me much, or it benefits people widely, or if it just feels good to do, if it gives me life, I strongly prefer to do something freely, by generosity, because it builds relationships and serves the world.

- If it costs me a lot of time, energy, money, or resources, if it just benefits a few specific people or has extensive opportunity costs, or if it is not something I would enjoy doing in and of itself / might not be life-giving, I will charge money for a program as a way to value my time, energy, expertise.

I found this helpful to write down and make explicit. I might change my mind about all of this in the future—I’ve already changed my mind about these things so many times in my life—but this is how I see it now!

At present, I am trying to learn skills related to commerce, capitalism, and doing business so that I can have additional income streams, help more people, develop and grow in new ways, and then create mutually supportive positive feedback loops between commerce and generosity, between my relationship with the traditional economy and my ability to do fun service projects through The Service Guild that may not have legible or measurable market value.

Practically, I think it would mean having a really strong feedback loop between what I’m doing by generosity and what I’m doing commercially, between my own personal work and the resources and infrastructure of The Service Guild.

I don’t think making money commercially compromises my values per se, especially since I have really clear boundaries and intentions on what I will and will not charge for commercially.

I’ve been designing a number of offerings that I could launch, and will be doing so in the coming weeks and months.

Ideally, these offerings not only generate income, but also help me to learn and grow, and get better at helping people individually—and then I can generalize what I learn into blog posts, videos, and larger service projects. I feel really excited about this direction, and the possibilities it will open up!

Seeking Help with Money

I recently found a money service that looked interesting and like it could meet some of my goals. I scheduled an intro call with them. I got on a call with a team member who would be my accountability coach if I worked with them.

I asked some questions myself, about their pitch. They offer ten services:

- 1:1 Live Coaching

- Monthly bookkeeping

- Spending management

- Saving automation

- Debt repayment planning

- Retirement planning

- Financial education

- Tax consultation

- Insurance assessment

- Estate/legal referrals

My sense was that I needed four of these, didn’t need another four or five, and that they were missing 3-4 services that I wanted and needed but they didn’t have.

I also felt like their mode of working, and some of the specific things they would need me to do, wouldn’t work for me for various reasons.

At the simplest level, I needed more support as a self-employed person and that was an edge case in their system.

I trusted them to be good at the services that they said they would offer, to be ethical and responsible and competent at what they explicitly offer publicly, but I didn’t trust them to meet all my needs or help me meet all my goals, or to do so in a way that felt good for me personally. Given that equation, it wasn’t worth paying them to help me with a partial part of my goals.

That said, I was grateful for this experience because it helped me to clarify what I do and do not need, so that I can make sure to meet those needs, even if it’s in a different or unusual or duct-taped-together sort of way.

I do need or want:

- 1-1 Live Coaching

- Monthly bookkeeping

- Tax consultation

- Support investigating starting an LLC, running a business operationally

- Support investigating a fiscal sponsorship and/or establishing a non-profit, or other similar vehicle

- General financial education

- General counsel and advice

- Psychological coaching, debugging, unblocking

I plan to try to meet these and other needs in the coming months and years, so that I can work towards my financial goals, and be set up for success with my larger ambitions, visions, and dreams.

Planning for my Financial Future

I recently made a pre-requisite tree to map out my next steps with my financial flourishing endeavors. Here’s how I see my financial situation unfolding in the near future—what efforts I’m practically putting towards these goals.

There are several key categories: Clarity, Infrastructure, Income Streams, The Service Guild, Brooklyn Move.

Clarity: Writing this money story has helped me to begin getting clear on my history, my patterns, my needs, and desires for the future. I’ll continue talking to mentors and allies, showing them my thinking, and asking for help. I want to build a team of people who care about my flourishing and can offer guidance, accountability, and support.

Infrastructure: I need to file my 2025 taxes without the usual dread. I also want to have boring-but-essential systems, like a bookkeeper, an accountant, clear tax infrastructure.

Income Streams: I’m pursuing multiple paths in parallel: launching and marketing commercial offerings, growing my Patreon, and investigating the possibility of applying for grants (Emergent Ventures, OSV, etc.) or getting a job.

For the commercial offerings, I’ve created an SOP for launching commercial offerings. I’m very proud of it, because I think it shows a lot of thought for how business works (despite being relatively new to business, inexperienced) but also care for how I want to work, how I want to show up—to ensure I create something I’m a hell yes to, that I’m excited about and can learn and grow from—to ensure I launch something I’m proud of, that I truly believe will benefit others and be worth their money. I’ve been iteratively revising it. I would love for some of my friends to use it, so I’m making it publicly available.

The Service Guild: I want to explore the possibility of getting fiscal sponsorship, so the Guild can receive donations as a nonprofit. I also need to get clearer on what I and others want for the Guild’s future.

Brooklyn Move: Ulysse and I want to move to Brooklyn. We probably can’t do that until at least one of us has a W2, which means either I get a job or Ulysse finishes his bootcamp and lands one. May is probably the earliest we could move.

If I make progress on these fronts—clarity, infrastructure, income, the Guild, the move—that should result in reaching my Livelihood Spell goal: earning $3,000/month or much more, feeling peace and safety with money, and being set up to thrive in Brooklyn and in the years to come.

I don’t know for sure if I will be able to realize this goal by the date I picked—June 1st—but that’s my aimline, and I will keep working until I do.

My Philosophy of Money

Money is an external, worldly symbol of life energy. We need to really look at our feelings and beliefs about it, and develop a healthy relationship with it, because they parallel other areas of our life. It’s important to be willing to be generous, to give freely to what your heart and intuition and conscience are called to. It’s important to know that money is not intrinsically valuable—it’s people that matters, our conduct that matters. It’s important to be willing to receive, also. To accept what wants to come to us.

I think the idea of tithing is spiritually very clear and clean. To be generous and give back with at least 10% of our money. To not hold on to it, or store or hoard it, but give freely.

I think it behooves us to steward our money, to be considered and thoughtful and caring with how we use it. It’s the attitude we have towards saving and investing and spending that matters, rather than whether we are doing so at all.

My belief in magick informs how I relate to material resources. At a deep level, I think the bodhisattva vows are a wholesome cosmic spell. I believe that so long as I give my life to service and benefit, I will have what I truly need. It may take time to manifest, or for me to earn it, but I have confidence in my own goodness and intent, and trust the universe as a whole to provide what I need to act on that goodness. I have a lot of earned trust in the universe at this point because I’ve made my life work so far, through grace and goodness.

I think that in this lifetime, on this Earth, I am learning to see money as metadata—to both relate to it practically and with skill and precision, without buying into it, reifying it as inherently intrinsically meaningful or worth acquiring for its own sake. I believe I am to use money for service, and benefit—to use my skills for maximum deep benefit as best I know how, and money to amplify those intentions and their positive impact.

Conclusion

I recently met someone who is very interested in Vedic Astrology. They looked at my chart and told me that when I am 36, money will be solved—no longer a problem in my life.

Honestly, that timeline tracks with my current sense of things. I’m putting in the work in that direction now, I’m putting effort and care and thought towards making it so—but it takes time, years of planning and execution to bring it about. As I write this, I am 34; I will turn 35 this year, in June; so if they are right, I have another 18 months or so before money is cracked.

I believe that it’s not just me that will shift my relationship with money. I foresee that our world as a whole will develop a new relationship with money: one of abundance and mutualism, interdependence. I am an optimist, by nature and choice—in all matters, and also in this.

May I truly reach financial safety, abundance, and flourishing. May my well-being be a basis for The Service Guild to grow and prosper in its strength, skill, and impact—a foundation for genuine, deep service to the world, for maximum deep benefit.

May we truly enter the heavenly realm on this planet, in our lifetimes, and may that era serve all living beings. ❤️

If U’ve read this money story, and are invested in my flourishing, I would love for U to look at my Help Me and/or Hire Me pages!